Dollar General is a big winner from Trump’s tariffs. Why that’s bad news for rural communities.

Happy June, the Rural Angle readers! Before we dive into today’s news, a special announcement: this is an election year for the Virginia state assembly and New Rural Virginia will soon be inaugurating a podcast featuring Democratic candidates in rural districts. It will be a great opportunity not just to get to know the candidates but to explore the issues and opportunities important to rural Virginia communities. Stay tuned!

And now on to the story!

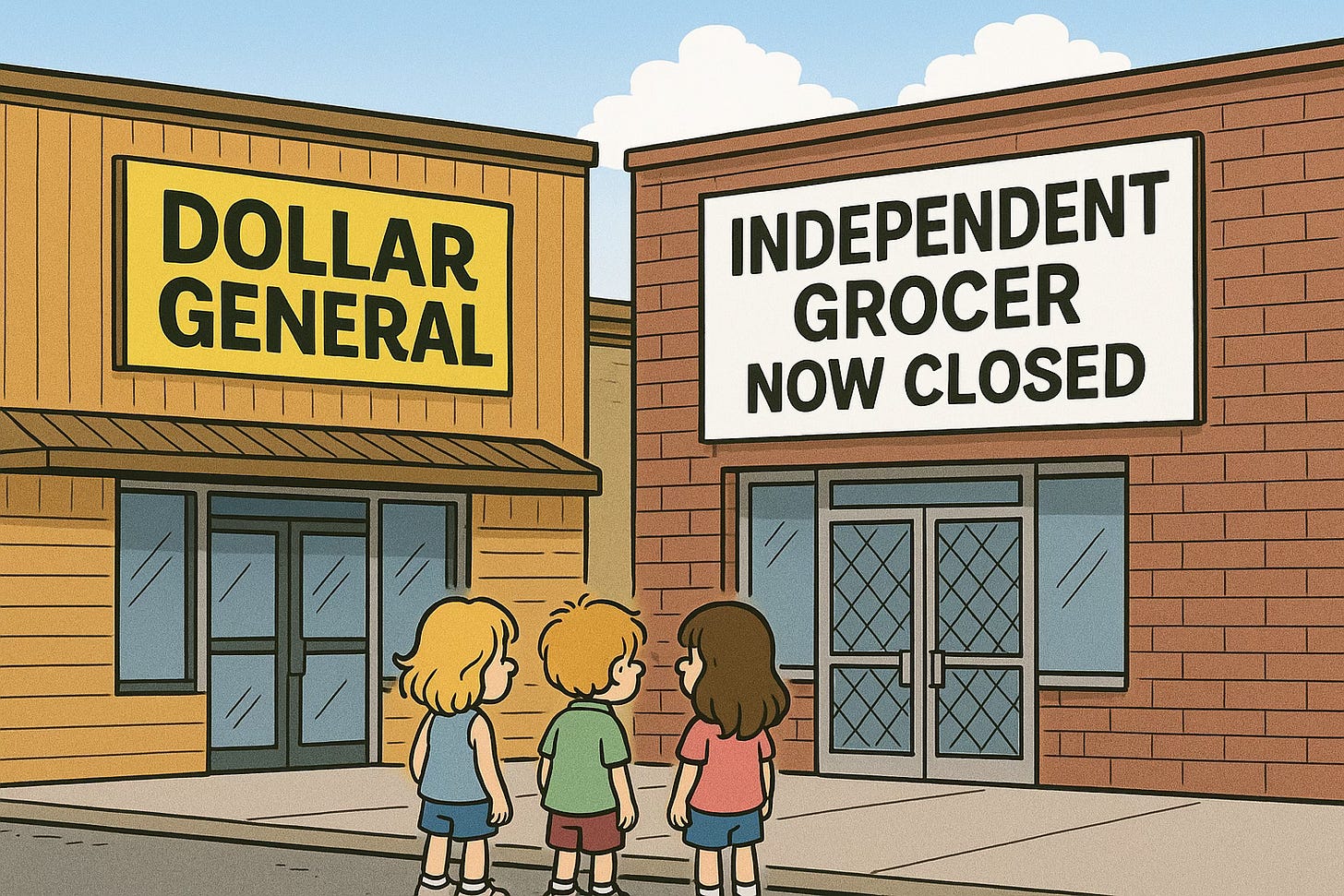

Dollar General, the national mega-retailer whose 20,000 stores dominate many rural communities, just reported soaring earnings for the first quarter of 2025. Moreover, the company promised strong results for the rest of the year as well. Not surprisingly, its stock has soared nearly 30% in the 3 months since Trump’s tariffs were announced.

Yet there is something really bizarre about this story: In the same call in which the company crowed about its earnings success, it also reported that its (mostly rural) customers were doing really badly. In fact, it acknowledged: “25% of (Dollar General) customers reported having less income than they did a year ago -- and nearly 60% of our core customers noted that they felt the need to sacrifice on necessities in the coming year.”

Why is Dollar General doing so well if its customers are hurting?

So, if DG’s customers are doing so badly, why is the company doing … just great? Because the chaos and uncertainty created by Trump’s tariffs will hurt even more the small, independent stores that are the company’s main competitors. As Bloomberg explained, “Dollar General is the perfect example of what matters now; scale and the market power that comes with it. Not only is it in a position to negotiate with its suppliers on price (and potentially get them to absorb some of the tariff costs) but it also has enough pricing power to force through price increases on its customers if it has to.”

How the tariff war worsens an already unfair playing field for independent retailers

In short, the short-term pain of tariffs is the perfect tool for Dollar General to accelerate what it has long been doing in rural America: squeezing out local competition and further consolidating its control over its customers. So one lasting legacy of Trump’s tariff war’s could be an acceleration of the trend toward fewer independent rural retailers. And not just grocers: as Investigate Midwest points out, new dollar stores (Dollar Tree and Family Dollar are the other big dollar store players) in a rural community generally result in fewer pharmacies, hardware stores and other independent retailers. And that is a great reason for Dollar General’s owners to celebrate.

This challenge of the unfair playing field is just as real, though in a different way, for family farms. As Food and Water Watch recently pointed out, tariffs during Trump’s first term created a farming crisis -- which led to a costly bailout that mainly benefitted big agro-industrial corporations. That seems likely to happen again. Meanwhile, the small farmers, in many cases financially hit hard by the loss of export markets, are forced to sell or lease their land – often to those same agro-industrial corporations.

The high price of (needless) uncertainty for rural communities

Trump campaigned on a promise to help the little guy. Yet he also seems to relish the attention he gets from raising and lowering tariffs daily, with just a stroke of his pen (or a tweet). That may be great for him — but it is terrible for rural America’s independent retailers and family farmers.

They have neither the clout with suppliers to hold down price increases nor the deep capital reserves needed to weather the market upheaval that Trump creates daily. Mother Nature already delivers plenty of uncertainty — the last thing they need is for their president to pile on more.

Interested in The Rural Angle’s articles on similar topics? Find them below:

March ‘25: The Problem with Eggs

August ‘24: The Problem with Pharmacy Benefit Managers

March ‘24: Cracking Down on the Corporate Monopolies Behind Skyrocketing Inflation

December ‘23: Healthcare Consolidation and Corporate Greed